28+ ratio of income to mortgage

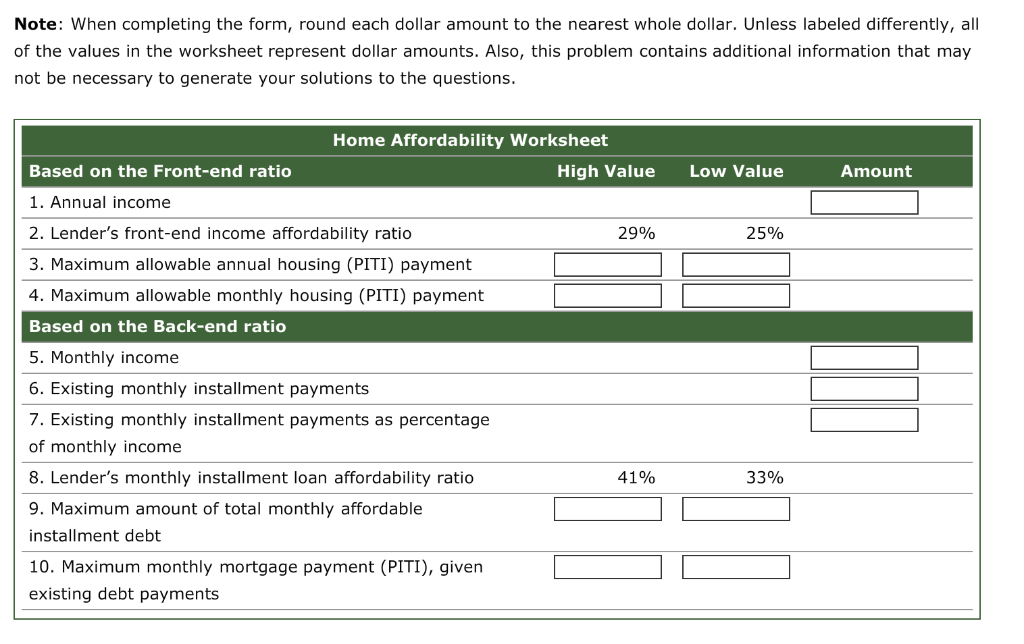

Lenders prefer borrowers with a. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

What Percentage Of Income Should Go To A Mortgage Bankrate

Were Americas Largest Mortgage Lender.

. Web Typically lenders cap the mortgage at 28 percent of your monthly income. A Critical Number For Homebuyers One way to decide how much of your income should go toward your mortgage is to use the 2836 rule. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Heres how lenders typically view DTI. Ad Buying A Home.

If we look at. Lets look at an example to make this clearer. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You. Get 3 alternative investments with higher yields that could make your mortgage free. Ad Compare Mortgage Options Calculate Payments.

Apply Now With Quicken Loans. Web The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate the typical local homeowners income and the typical local home value. Web NerdWallets debt-to-income ratio calculator can help you estimate your DTI based on current debts and a prospective mortgage.

To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. Find A Lender That Offers Great Service. Ad One Size Doesnt Fit All - Explore Personalized Loan Options As A First-Time Homebuyer.

Compare More Than Just Rates. Heres what to know. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

Offering A Wide Range Of Mortgage Products Competitive Rates Low Down Payment Options. Ad Calculate the monthly and total payments of a mortgage. Web Mortgage lenders typically look for debt-to-income ratios of 36 or lower.

The ratios mentioned above with regard to your DTI are often summarized at the 2836 rule meaning your mortgage payment shouldnt be more. Apply Now With Quicken Loans. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

Ad Our Mortgage Options Are Designed To Support Homebuyers In All Stages Of Life. Web How much of your income should go toward a mortgage. Web The 28 rule refers to your mortgage-to-income ratio.

Ad Compare Mortgage Options Calculate Payments. Ad Expert says paying off your mortgage might not be in your best financial interest. Lock Your Mortgage Rate Today.

Our Team Provides End-To-End Guidance To Help You Choose The Right Mortgage For Your Needs. The 2836 rule is a good benchmark. No more than 28 of a buyers pretax monthly income should go toward.

Web The 2836 Rule. Web According to Investopedia in general you and mortgage lenders do not want a total debt-to-income-ratio over 36. Lock Your Mortgage Rate Today.

To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the. Web What is the 28 36 Rule of debt ratio.

Were Americas Largest Mortgage Lender. For example if you have 1000 of monthly debt and make 3500 a month then your debt-to-income ratio would. Well Automatically Calculate Your Estimated Down Payment.

Web When considering a mortgage make sure your. Standard FHA guidelines accept a ratio as high as 43.

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Is The 28 36 Rule Of Thumb For Mortgages

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Shannon Janecek Operations Manager Homexpress Mortgage Corp Linkedin

Sec Filing Crossfirst Bankshares Inc

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Ex 99 1

Learn More Details About Dti Taylor Carroll Realtor Facebook

Solved The Two Borrowing Criteria Used By Most Lending Chegg Com

Percentage Of Income For Mortgage Rocket Mortgage

How Much Mortgage Can I Get For My Salary Martin Co

Pdf Minimum Income Schemes In Europe A Study Of National Policies

Why Mortgage Applications Get Rejected What To Do Next

Affordability Calculator How Much House Can I Afford Zillow

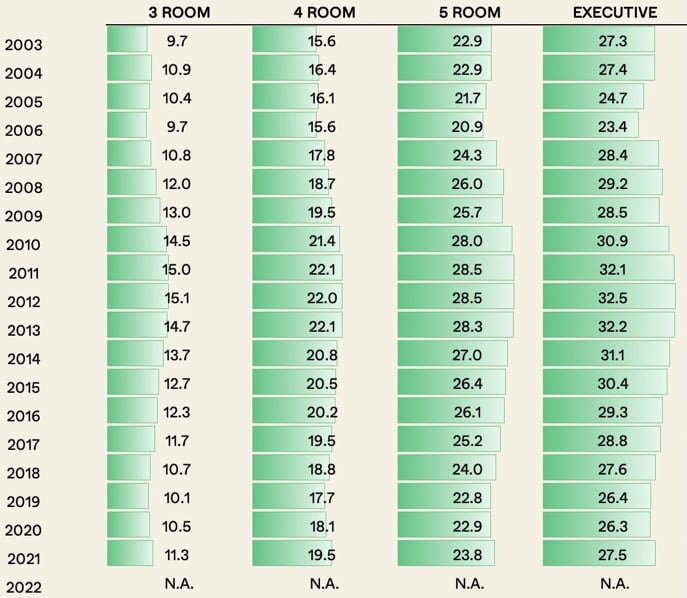

Analysis Are Hdb Flats Really As Unaffordable As Everyone Claims We Look At 468600 Transactions To Find Out

Back End Ratio Definition And Meaning Market Business News

The 28 36 Rule How To Figure Out How Much House You Can Afford